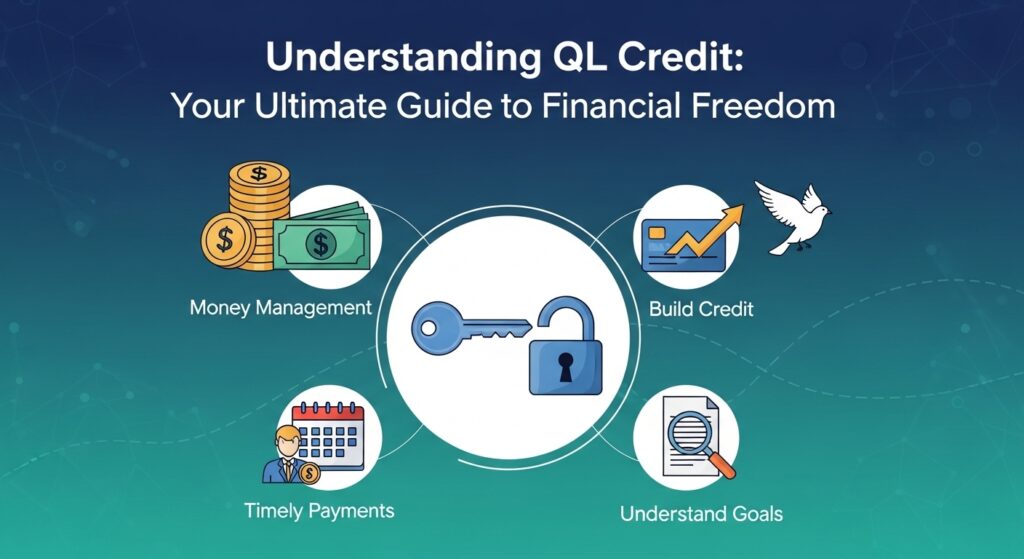

In today’s fast-paced financial landscape, understanding your credit can be a game-changer. Enter QLCredit—a term that may not yet be familiar but is essential for anyone looking to navigate the world of personal finance with confidence. Whether you’re aiming to buy a home, secure a loan, or simply want to improve your financial health, knowing how QL Credit works will empower you to make informed decisions.

Imagine being in control of your finances and having access to better interest rates and offers. That’s the promise of maintaining a good QL Credit score. But what exactly does it entail? And how can you leverage it for greater financial freedom? This guide will break down everything you need about QL Credit—from its significance in your life to tips on enhancing and maintaining an excellent credit score. Get ready to unlock the door to opportunities!

What is QL Credit?

QL Credit refers to a specific credit evaluation system used primarily by Quicken Loans, an established name in the mortgage industry. It focuses on assessing an individual’s creditworthiness through various metrics.

Unlike traditional scoring models, QL Credit emphasizes factors that matter most when securing loans or mortgages. It not only looks at your payment history and outstanding debts but also considers income stability and overall financial behavior.

This tailored approach helps lenders make informed decisions while providing consumers with a clearer picture of their credit standing. Many people are unaware that such specialized systems exist, which can significantly impact loan eligibility and interest rates.

Understanding QL Credit can give you an edge in navigating the often-complex world of borrowing. By familiarizing yourself with how it operates, you’re taking a proactive step toward mastering your financial future.

The Importance of Credit Scores

Credit scores play a crucial role in your financial life. They act as a snapshot of your creditworthiness, reflecting how reliable you are when it comes to borrowing money. Lenders use these scores to assess the risk of lending to you.

A high credit score can open doors for better loan terms and lower interest rates. This means saving money over time, especially when it comes to mortgages or car loans. Conversely, a low score may limit your options or result in higher costs.

Beyond loans, landlords often check credit scores before renting properties. Employers may even review them during the hiring process, particularly for positions that involve financial responsibilities.

Understanding the significance of your credit score is essential for making informed financial decisions and achieving long-term goals.

How QL Credit Works

QL Credit operates as a comprehensive platform that simplifies the credit management process. It provides users with insights into their financial behavior, helping them understand how lenders view their creditworthiness.

When you sign up for QL Credit, you’re granted access to your credit report and score. This information is crucial as it reflects your borrowing history and current financial health. Users can monitor changes over time, making it easier to track improvements or identify areas needing attention.

The platform also offers tools designed to enhance your understanding of factors affecting your score. From timely payment reminders to personalized tips on reducing debt, QL Credit empowers individuals to take charge of their finances confidently.

Moreover, QL Credit collaborates with various lending institutions. This partnership ensures that users have access to tailored solutions based on their unique financial profiles.

Benefits of a Good QL Credit Score

A good QL Credit score opens doors to various financial opportunities. It can significantly lower your interest rates on loans and credit cards, leading to substantial savings over time.

With a strong score, lenders view you as a trustworthy borrower. This perception often results in greater borrowing limits, allowing for more flexibility in managing expenses or investing in significant purchases.

Additionally, many landlords check credit scores during the rental application process. A high QL Credit score can make securing that dream apartment much easier.

Insurance companies may also consider your credit history when determining premiums. Better scores typically lead to lower rates on auto and home insurance policies.

A solid QL Credit score provides peace of mind. Knowing you’ve built a robust financial foundation allows you to focus on achieving other personal goals without the stress related to poor credit management.

How to Improve Your QL Credit Score

Improving your QL Credit score can be a straightforward process with some diligence. Start by checking your credit report for errors. Disputing inaccuracies can lead to an instant boost.

Pay down existing debts, especially high balances on revolving accounts like credit cards. This not only lowers your utilization ratio but also demonstrates responsible borrowing habits.

Timely payments are crucial. Set reminders or automate payments to ensure you never miss a due date. Each positive payment builds trust with lenders over time.

Consider diversifying your credit mix too. A combination of installment loans and revolving credit can enhance your score significantly when managed well.

Avoid opening multiple new accounts in a short period, as this increases hard inquiries on your report, which might temporarily lower your score. Focus instead on building long-term relationships with creditors for steady improvement.

Common Misconceptions about QL Credit

Many people harbor misconceptions about QL Credit that can hinder their financial decisions. One common myth is that checking your own credit score negatively impacts it. In reality, this is considered a soft inquiry and has no effect on your score.

Another misunderstanding revolves around the belief that closing old accounts will improve credit scores. This can actually harm your score since it reduces your overall available credit and shortens your credit history.

Some think only loans or major purchases affect QL Credit scores, but even small debts like unpaid bills can play a significant role in determining health.

Additionally, there’s a notion that you need to have debt to build good QL Credit. However, responsible management of any existing accounts often speaks louder than simply accumulating more debt.

These misconceptions can lead to poor financial choices if not addressed properly.

Tips for Maintaining a Good QL Credit Score

To maintain a good QL Credit score, consistency is key. Start by paying your bills on time. Late payments can have a significant negative impact.

Next, keep your credit utilization low. Aim to use less than 30% of your available credit limit. This shows lenders you’re responsible with borrowing.

Regularly check your credit report for errors. Mistakes happen and correcting them can boost your score instantly.

Additionally, avoid opening too many new accounts at once. Each application results in a hard inquiry which can temporarily lower your score.

Consider keeping older accounts active, even if you don’t use them often. Length of credit history plays a role in how scores are calculated.

Create a budget that includes all financial obligations to prevent missed payments or overspending. Being organized reduces stress and supports better financial habits long-term.

Conclusion

Understanding QL Credit is essential for anyone looking to achieve financial freedom. By grasping what QL Credit entails and recognizing the significance of credit scores, you empower yourself to make informed decisions. Knowing how QL Credit works provides clarity on its mechanics and functionalities.

With a good QL Credit score, you open doors to numerous benefits that can enhance your financial well-being. Improving your score may take time and effort, but it’s undoubtedly worth it in the long run. Overcoming common misconceptions about QL Credit also plays a vital role in shaping your understanding of this crucial aspect of personal finance.

Maintaining a strong QL Credit score requires diligence and commitment. With effective tips at hand, you’re better equipped to navigate your credit journey successfully. Taking charge today paves the way for tomorrow’s financial security and opportunities ahead.